Tuesday, June 17, 2008

Thursday, May 29, 2008

Monkey See - Robot Do

Thursday, May 15, 2008

Skynet For Shizzle

Technology and Loophole

In The Almost Cool Segment

Speaking of Ironman...

Wednesday, May 14, 2008

Creative Accounting Keeps Inflation Under Control

What a load of B.S.!

The True AMERICAN IDOLS!!!!

What can I say, it was a good laugh

Tuesday, May 13, 2008

Watching the Watchlist

Here we are in another week of trading and there is still money (latinum) to be made. I think there are a lot of stocks out there that are either on the verge of bouncing and starting on heading up or have already turned and marching forward to a new top. Use these stocks to start building your own watchlist and keep an eye on those break outs. Here are some stocks that that are at a resistance level and verge of a break out and possibly it will put the oo-mox back into your trading....

BBV - CNQR - DECK - DNR - DV - FLIR - GMCR - MPWR - MVL - OTEX - PSEM - SDA - STD - WRNC

I like MVL because they know how to make a great movies like Iron Man and also the Hulk this summer along with the merchandising that comes with it should be huge.

A good movie made from a comic book equals a lot of money. So keep an eye on it.

These are just a few of my favorite things. Have fun with them.

Bernanke Sees Improvement

Monday, May 12, 2008

This Says It All

Thursday, May 8, 2008

Cool Pen and Cool Technology

Even though this company isn't public yet, there are a lot of possibilities with this type of technology. Apparently, the owner of Lightscribe use to work for Leap Frog Fly division of the Leap Frog company (that company that your children know about even if you don't.) You write on the special paper and it is stored on the internal hard drive plus much much more. You can read about it here.

Tuesday, May 6, 2008

Cornerstone Growth

CALM - Uptrend with momentum, 10.5% dividend yield

AKS - Support bounce off a 30-day moving average

KOP - Pennant flag break out, 1.86% dividend yield

CQB - Support bounce off a 30-day moving average

FLR - Support bounce off a 30-day moving average beware of $170 as resistance but allow room for a break

ACU - Retesting an ascending triangle

BG - Support bounce

WMT - Pulling back look for a bounce or bull flag, 1.64% dividend yield

NM - Broke resistance w/ volume, 3% dividend yield

GSI - Awesome fundamental stock, Bull flag for a target of $13.50 in the short-term but don't be afraid to let it run

MEA - Forming a bull flag as it is retesting a major resistance break from last month

MAN - Last 6-months has been consolidating and reversing now making a higher low

Sunday, May 4, 2008

Spider Surveillance

Saturday, May 3, 2008

Wednesday, April 30, 2008

Is Al Gore also the inventor of Green Investing?

So, he couldn't be president. I think he is very happy with that now. He probably will be able to have more influence and make a hell-of-a-lot more money being GREEN!

Tuesday, April 29, 2008

Are Biofuels the Problem?

Since the all the rules of acquisition are all about profits and gaining as much as possible, can you fault farmers in taking the initiative to gain as much of it as possible? Here are some biofuel stocks that I am looking at currently and really see if some profits can be made.

ADM

BG

BP

CAG

CVX

MON

PEIX

RDS.B

One little wrinkle in the whole genetically modified seeds that is the largest component of ethanol, is that the UN has created a task force on world food prices. This may cause a problem with the worlds largest genetically modifying engineering of biofuels company, ADM. They have already halted construction of 2 plants for creating biofuels.

What do you? You want to help the environment but do not want to pay the price? It is cause and effect theory.

Monday, April 28, 2008

Can you afford $10 a gallon????

Renewable energy legislation will be pushed through and stocks like FSLR. So, start putting in those solar panels now or buying carbon offset!!!

Gene Therapy gives Sight

Worldwide Water Woes

Clean water it is becoming even more difficult to obtain throughout the world due to growing population and poor stewardship of current resources. Read through this long, long, article and see if you don't want to purchase the Water Resource exchange-traded fund (PHO). Maybe I will become a moisture farmer like those on Tatooine.

Robotics Improving Heart Surgury

SWEET! Oomox Trader found the right stock it is Intuitive Surgical ISRG.

Friday, April 25, 2008

Nuclear Power the ONLY Real Alternative

In light of the food shortages caused in part by alternative foods, nuclear power is becoming the only real feasible alternative energy source. Currently wind and solar can't create the capacity needed, once again bringing us back to Nuclear Energy. Even the founder of Greenpeace believes it's time to assimilate it as an alternative. The exchange-traded fund for Nuclear Power is NLR, which gives you a way to profit.

In light of the food shortages caused in part by alternative foods, nuclear power is becoming the only real feasible alternative energy source. Currently wind and solar can't create the capacity needed, once again bringing us back to Nuclear Energy. Even the founder of Greenpeace believes it's time to assimilate it as an alternative. The exchange-traded fund for Nuclear Power is NLR, which gives you a way to profit.

Numerous States Already Feeling Recession

Wednesday, April 23, 2008

ETF Watchlist

Basic Materials XLB - Broke out last week and is retesting

Consumer Staples XLP - Still trending sideways but is showing relative strength, historically a very strong industry group during a recession

Energy XLE - Broke resistance about a month back and is finally pulling back some, buy on the bounce

Utilities XLU - Low interest rates drives investors to the markets looking for high dividend yields

Tuesday, April 22, 2008

Are they Vulcan ships?

Friday, April 18, 2008

Good Earnings or a Sham?

Consulting: If you can't be part of the solution, there is good money in prolonging the problem.

ADP - Automatic Data Processing

ERES - Eresearch Tech

FCN - FTI Consulting

GPN - Global Payments

HEW - Hewitt Associates Inc

HIL - Hill International

IBM - International Business Machines

IT - Gartner Inc.

MA - Mastercard

MAN - Manpower

MCHX - Marchex Inc

NCI - Navigant Consulting

PAYX - Paychex Inc

PRAA - Portfolio Recovery Accociates

VVI - Viad Corp

WW - Watson Wyatt Worldwide

WXS - Wright Express Corp

Wednesday, April 16, 2008

Hedge your Shopping List

Assuming you're not one of those people who work for the Fed who believe that food and energy don't count as inflation, you have probably noticed the rise in food costs. The world is seeing inflation from a rise in demand for human consumption and energy alternatives. You can actually profit from this phenomenon by investing the DBA Agricultural exchange traded commodity fund.

Assuming you're not one of those people who work for the Fed who believe that food and energy don't count as inflation, you have probably noticed the rise in food costs. The world is seeing inflation from a rise in demand for human consumption and energy alternatives. You can actually profit from this phenomenon by investing the DBA Agricultural exchange traded commodity fund.

Tuesday, April 15, 2008

Value and Dividend Watchlist

This is a list of stocks I like that are fundamentally strong, low valuations, great dividend income, and are uptrending or within a basing pattern.

Symbol - PE Ratio - Div Yield

AZN - 11 - 6.79%

TOT - 8.5 - 4.00%

BDK - 8.5 - 2.54%

COP - 11 - 2.36%

TCK - 12 - 2.19%

MT - 11 - 1.80%

SAFM - 9 - 1.44%

Thursday, April 10, 2008

Oo-mox Watchlist

My current watch list is made up of several different stocks and some currencies. I am looking at mostly with a technical analysis view on each position. As time goes on, I will follow these stocks and bring some more and take some away. Tell me what your thoughts are going forward.

URBN

AGU

My next stock that I am watching is AGRUM Inc (AGU). I love this type of set up because it is setting up to be a ascending triangle. If this pans out and breaks the tested resistance of $75, we could see a $20 move from the break of $75 area. It may test the resistance again and break down to the diagonal support and then break. We will see, wont we!!!

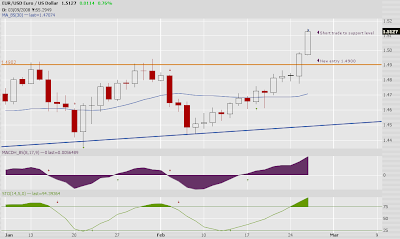

EUR/USD

Now, I thin the best one yet because our good old greenback is not doing so well and may have some breaking down still in its future, at lest into summer. Therefore, I think this pair will run through 1.5900. This pair is setting up a nice ascending triangle and with a potential 600 pip move before it gets too extended. With the financial s companies still looking for handouts from the government and lending to retail clients dried up like a tight sphincter, and still more write offs still not taken, we will see some more weakness in the dollar. Watch this one carefully.

Tuesday, April 8, 2008

Liquidity Translation

Thursday, April 3, 2008

The Cure for High Oil Prices

Can more regulation and more taxes somehow bring down oil prices? What in the heck are they thinking in Washington. Commodities and stocks work in long-term 18 year cycles. That is what happened in the 1900s, 1930s, 1970s, and today. It isn't government conspiracy or Bush and his big oil friends who want to drill in Anwar it is demand from China and India coupled with a weak dollar. This is the price we pay when 3rd world countries progress and our Monetary policy makers lack backbone. Rejoice in the wealth being built in these countries and realize eventually, supply will meet demand through new wells, efficiency gains, and alternatives. It is not an over night fix so be ready to endure high inflation for quite some time. There are plenty of ways to profit from this commodity boom so become educated. Read the not so well written but sufficient book "Hot Commodities" by investing legend Jim Rogers!

Can more regulation and more taxes somehow bring down oil prices? What in the heck are they thinking in Washington. Commodities and stocks work in long-term 18 year cycles. That is what happened in the 1900s, 1930s, 1970s, and today. It isn't government conspiracy or Bush and his big oil friends who want to drill in Anwar it is demand from China and India coupled with a weak dollar. This is the price we pay when 3rd world countries progress and our Monetary policy makers lack backbone. Rejoice in the wealth being built in these countries and realize eventually, supply will meet demand through new wells, efficiency gains, and alternatives. It is not an over night fix so be ready to endure high inflation for quite some time. There are plenty of ways to profit from this commodity boom so become educated. Read the not so well written but sufficient book "Hot Commodities" by investing legend Jim Rogers!Interesting side note, the week of Black Thursday just before the Great Depression, congress was holding hearings on how to tax the railroads for their "windfall profits". You gotta love government. I bet if you looked back in 1999 when oil was trading around $11 a barrel congress was looking for a way to subsidize the oil companies to keep them afloat. Sometimes you get the bull like these oil guys are now, sometimes you get the horn like they did in 1999 and couldn't stay in business.

Tuesday, April 1, 2008

No Foolin I'm Bullish

Don't get get me wrong, I am long-term bearish still. I think we will see the CNBC and BTV start marking the end of the credit crisis, calling Bernanke a hero, but the rally will be a sucker's rally. We have another $300 billion in losses coming for our countries financial institutions, we will see interest rate hikes later in the year when the Fed is forced to address inflation, and the rest of the world is now feeling out financial pain. Play the bullishiness while it last but use stops and position sizing!

Saturday, March 29, 2008

The Road to end Free Markets

Why can't we accept recessions as a normal part of life, as a healthy shake out, as way the invisible hand disciplines the ignorant the greedy. Congress reminds me of the parent who won't allow a child to feel the weight of the consequences of their choices and then can't figure out why the child is such a loser when faced with life on his/her own.

Thursday, March 20, 2008

Nuts and Bolts of It

Look at the Inverse Head & Shoulders pattern on Fastenal Co. (FAST). According to the pattern it should move up to $55 in the next 5 months. Terrific volume confirmation with the MACD lows moving higher gives great confidence in this trade.

Wednesday, March 19, 2008

The "NEW" Retirement Plan

Tuesday, March 18, 2008

Fed Speculation

Sunday, March 16, 2008

JPMorgan Calls in Bears' Note

Fed's Sunday Surprise

Saturday, March 15, 2008

What will change the world first, Communciation or Transportation.

Friday, March 14, 2008

Geordi Goggles

NASA has been working on JORDY glasses for some time, now Japanese scientist have now developed another set of glasses for the memory impaired.

Wednesday, March 12, 2008

EURO GONE WILD

I thought Gore invented the Web?

Recession Double Talk

A recession is defined by two consecutive terms of lower growth. If we see GDP at 5% than 4% than 3% we would say we're in a recession. What if we are at 5% than 3 % then up to 3.5% back down to 2.9%, is that a recession? According to the strict definition of a recession the answer is no. Now, what if we are at 5%, then 2%, and then grow to 2.01%, 2.02%, 2.03% and so on. Technically it isn't a recession but the economy sucks royal!!

Monday, March 10, 2008

****Spitzer Alert****

You Be The Judge!!

Innocent till proven guilty but he may get a piece of his own medicine. Payback is a @#$%&! But you really can fault a guy in getting his oo-mox on, right???

CLIENT Number 9

Governor Elliot Spitzer of New York City is on the verge of resigning today because he was caught in a prostitution ring sting. He just talked with reporters about how he needs to work on and focus on gaining his families respect and trust back. Well, that may be difficult since he was such a "defender of truth" in his prosecution days.

How can he think that he could get away with it being in a club called the Emperors club that sets up these prostitutes for high net worth clients. Also, on one of the busiest days of the year when individuals cheat on their spouse and government monitoring of this day for those cheats, February 13th (day before valentines day), you would think that this guy would know better. I guess that is why some in New York got the feeling that he had the "god" complex or untouchable air about him. I don't know him but this isn't good and must go down in a idiot-in-charge stupidity.

Again, there must be someway to make something off of this event. That is just how good Ferengi's think. I know others will. It is too bad but I think that all those that have been wronged by this guy, should have some fun and reprocussion on. All is fair in love and money!!! Have fun you Wall Street guys!!!!!!! Law and Order writers, you have an easy script here. Have some fun with it too.

My EUR/USD Trade

Going forward, I still see some bullishness around it as the dollar still weakens. There is talk now of the Fed possibly having an emergency cut because of the markets. I can't see it helping much and only postponing the inevitable. I definitely think that we are in a recession and even though we are no where like the 1920s, it still is a for of recession. In a article that is from 2006 on when recessions may have happened in the past, goes to show that we may be in a small one right now. This article goes into some good information on the make up of these recessions.

Now, my Ferengi side tells me that there is money(latnium) to be made in this time of crises. And that is what I am doing. I just have to be against the dollar till there is something that convinces me that it is turning around. Who know, maybe the dollar will become the new currency carry trade. Remember, making and getting latnium is the" true" oo-mox experience!!!!

We Need Food Synthesizers

Wednesday, March 5, 2008

Diana Shipping Inc. (DSX)

So, Bajoran Profit has been busy lately being a producer of some sorts and so asked me to post this information on Diana Shipping Inc. I am sure that he will be writing more on this position later.

DSX currently has a peg ratio at .74 and a dividend yield over 8% and has recently bounced off a good support level. There could be a return to a $32.50 level and then on up even higher. These are my thoughts but Bajoran Profit can speak for himself.

As for me, I am going to get some more latinum and have a party with my last trade on the Euro. Nice run and still running. The pullback never emerged but that is ok, I am still bullish. I see it going to 1.5450 at this rate. With the large ascending triangle that it made, this 500 pip move is possible. I am keeping my stops semi tight on the way up just in case some econo-nerd from the fed or government says something to pull it back. We will see.

- oo-mox

Tuesday, March 4, 2008

Hostile take over of Germany

Wednesday, February 27, 2008

My Euro Trade

Here is a trade that I recently did on the EUR/USD. I actually told several people to play the bounce off of a strong diagonal support level. There has been a strong resistance level at 1.4900 since November. The Euro has tested this level three times and also creating higher bottoms three times. On the last support level bottom that it created on 2/07/08, was a great entry play to the resistance level again. A move from 1.4500 to the resistance was the play to make. Who doesn't want to make 400 pips? I set my target at 1.4950 and got out yesterday with a 450 pip profit. Not bad for a very good predictive play.

Now the pair has broken this strong resistance level and is continuing up another 200 pips to a very overbought area. I expect a pull back now to the new support of 1.4900 and then a bounce back up to 1.51 to even higher levels. I really can see a move to 1.60 now a higher possibility over the next year. I guess a wait and see on that one. But an new entry at a bounce of 1.490 may be a good bounce.

New trades on the EUR/USD - one short reversal trade

For a short trade from these highs to 1.4900 may be a good quick short term play because of overbought area on the position. It may be good but be careful and have fun if you do. Watch your risk and don't over leverage.

We may see some wild things happening but I am in a short trade already to the support area. We will see how it goes.

Friday, February 22, 2008

Computer, Where's My Keyboard?

Thursday, February 21, 2008

Here Here!

Tuesday, February 19, 2008

More Doom and Gloom

Tuesday, February 12, 2008

End of the Internet

Tuesday, January 29, 2008

Do you have a Fed Hangover yet?

I guess it is wait and see for now and oo-mox till we know later on tomorrow from our Fed friends.

Monday, January 7, 2008

Clear Message from Universal Translators